Table of Contents

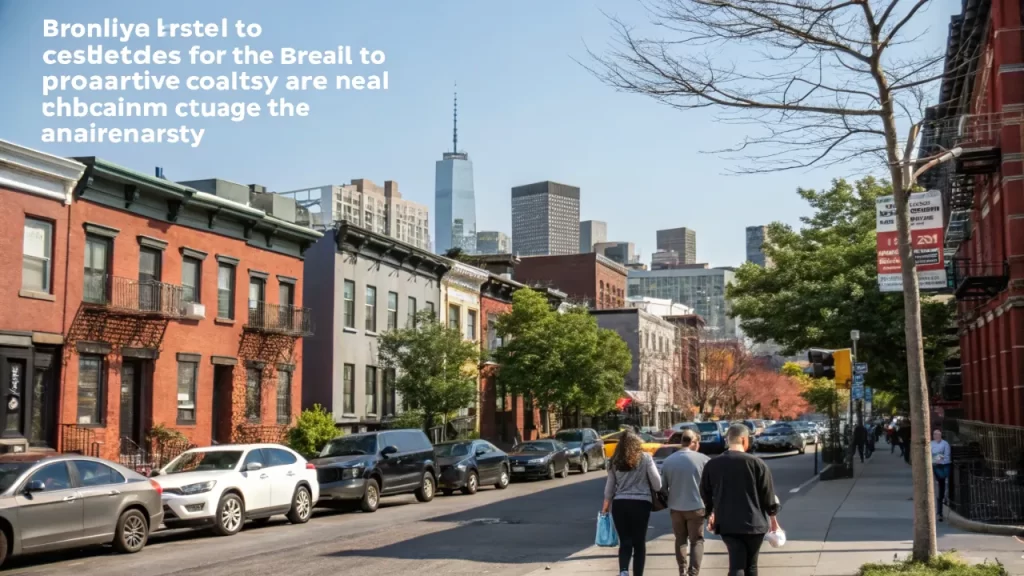

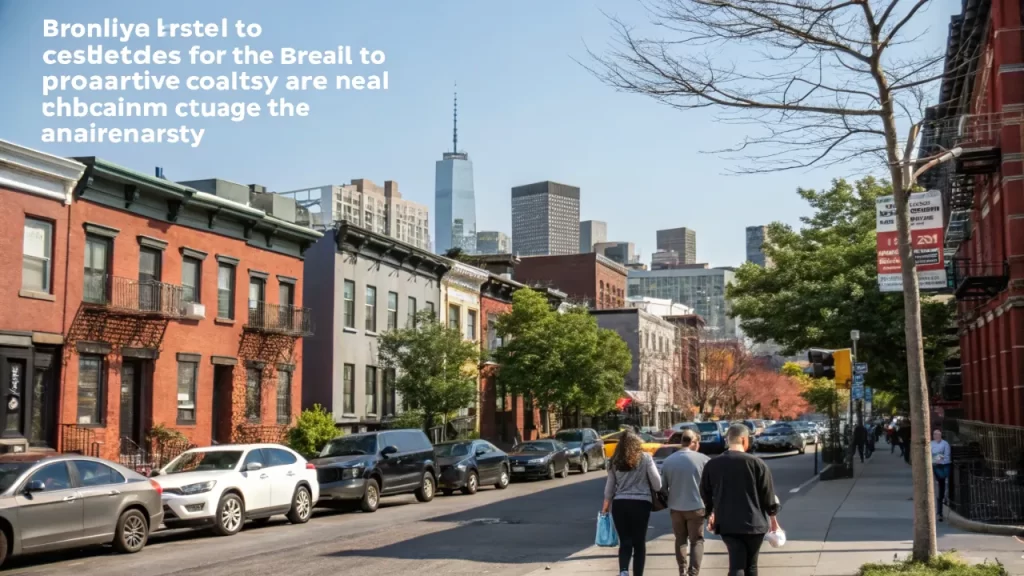

Brooklyn Real Estate Investing: Best Neighborhoods, Worst, and Expert Strategies for Success

Why Brooklyn Real Estate is a Prime Opportunity

Investing in real estate in Brooklyn offers incredible potential, but it’s not without its challenges. With high property prices, competitive markets, and a range of neighborhood dynamics, picking the right location is critical to ensuring a profitable investment new york real estate investment.

In this guide, we’ll cover the best neighborhoods to consider, which areas to avoid, and pro strategies to help you maximize returns. Whether you’re flipping, renting, or holding onto property for long-term appreciation, this article is your go-to roadmap for Brooklyn real estate success.

Best Brooklyn Neighborhoods to Buy an Investment Property

Finding the right neighborhood can make or break your success in nyc real estate investment. These Brooklyn areas offer great potential for flips, rental properties, and long-term value appreciation in investment houses for sale.

Bay Ridge: Suburban Charm Meets Affordability

- Why Invest: Bay Ridge is one of the most family-friendly areas in Brooklyn, with tree-lined streets, spacious homes, and a tight-knit community vibe. This neighborhood offers properties at lower prices compared to trendier parts of Brooklyn, making it ideal for investors seeking affordability and growth potential.

- Investment Strategy: Look for undervalued homes that need minor renovations. The family-friendly atmosphere makes it an ideal location for long-term rentals or first-time homebuyers.

- Pro Tip: Renovate homes with family-focused upgrades, like modern kitchens or backyard spaces, to increase property appeal. Investment property new york.

Williamsburg: The Hip, Urban Investment Hub

- Why Invest: Williamsburg’s mix of young professionals, artists, and established residents has turned it into one of Brooklyn’s trendiest neighborhoods. While prices have risen, strategic investments in real estate investment nyc overlooked properties can yield great returns.

- Investment Strategy: Find properties that have been sitting on the market for longer than usual. Sellers in Williamsburg are often open to negotiation, especially for homes that need work.

- Pro Tip: Aim for rental properties to cater to young professionals who prefer leasing over buying. Renovate with modern finishes to attract higher-paying tenants.

Also Read: Investing in Brooklyn Real Estate: A Strategic Guide to Success

Sunset Park: Affordable Housing with Room to Grow

- Why Invest: Sunset Park offers a unique mix of affordability and charm. Its diverse community and ongoing developments make it attractive to investors who want to renovate and rent.

- Investment Strategy: Look for row houses or older properties that can be updated to attract families or working professionals.

- Pro Tip: Although it’s a bit further from Manhattan, its median rent of around $2,000 per month provides stable returns fam properties. Ensure renovations are cost-effective and designed to attract tenants looking for affordability.

Brooklyn Neighborhoods Investors Should Avoid

why rental property is a bad investment? Not every neighborhood in Brooklyn is a goldmine. These areas are either overpriced or oversaturated, making it difficult to find profitable investments.

Park Slope: High Prices, Low ROI

- Why Avoid: Park Slope is a beautiful, family-oriented neighborhood known for its historic brownstones and excellent amenities. However, sky-high property prices make it hard for investors to achieve high returns.

- Investment Warning: Unless you have substantial capital and are prepared for minimal cash flow in the short term, Park Slope is better suited for primary homeowners than investors.

Cobble Hill: Oversaturated Market

- Why Avoid: Cobble Hill has historic charm and is a highly desirable area. But homes on the lower end of the market get snapped up quickly, often leaving investors with limited options and less time to research potential properties in invest new york real estate.

- Investment Warning: Competition is fierce, and overpaying for properties is a common risk. Without a clear long-term strategy, investors may find themselves stuck with a property that doesn’t deliver expected returns.

Pro Tips for Successful Brooklyn Real Estate Investing

Whether you’re new to real estate or have multiple properties under your belt, these strategies will help you navigate Brooklyn’s competitive market.

Leave Emotions at the Door

- Why This Matters: Many investors make the mistake of choosing properties based on personal preferences rather than objective criteria. Successful investing is about numbers, not emotions.

- How to Apply: Treat every property as a business decision. Analyze the potential ROI, rental yield, and repair costs. If the numbers don’t add up, walk away—no matter how much you like the house.

Prepare for Higher Down Payments

- Why This Matters: Investment properties typically require larger down payments than primary residences. Most lenders require at least 20%, and in some cases, more.

- How to Apply: Budget not just for the down payment, but also for renovation costs and unexpected expenses. The more you put down upfront, the better your long-term returns due to lower interest rates and monthly payments.

- Pro Tip: Use a down payment calculator to compare how different amounts affect your long-term profitability.

Know the Neighborhood Metrics

- Why This Matters: A neighborhood’s rental rates, property values, and recent price trends directly impact your investment’s profitability.

- How to Apply: Research the average rent prices, recent sales in the area, and local amenities. Don’t forget to factor in the proximity to public transportation and schools, which can increase property demand.

- Pro Tip: Even if the numbers seem favorable, always account for unforeseen expenses, such as repairs or vacancy periods. Be conservative with your projections.

Factor in Renovation Potential

- Why This Matters: Properties with room for upgrades often have the highest return on investment when done strategically.

- How to Apply: Look for homes that need cosmetic upgrades rather than major structural repairs. Kitchen and bathroom renovations generally provide the best returns.

- Pro Tip: Work with a trusted contractor who knows the local market and can provide realistic estimates on renovation timelines and costs.

Stay Updated on Market Trends

- Why This Matters: The Brooklyn real estate market is constantly evolving. Staying informed helps you identify opportunities before they disappear.

- How to Apply: Follow housing reports, attend local real estate meetups, and consult real estate agents who specialize in Brooklyn neighborhoods.

- Pro Tip: Look for upcoming developments, rezoning plans, or infrastructure improvements that can boost property values in the future.

Minimizing Risk and Maximizing Returns

Investing in Brooklyn real estate isn’t without its risks, but with thorough research, strategic planning, and the right mindset, you can turn potential risks into opportunities. The key is to stay flexible, diversify your investments, and choose neighborhoods based on data-driven analysis.

By focusing on up-and-coming areas like Bay Ridge and Sunset Park, avoiding high-priced markets like Park Slope, and following proven investment tips, you’ll be well-positioned for long-term success. Don’t let Brooklyn’s fast-paced market intimidate you—embrace its challenges, and you’ll reap the rewards.